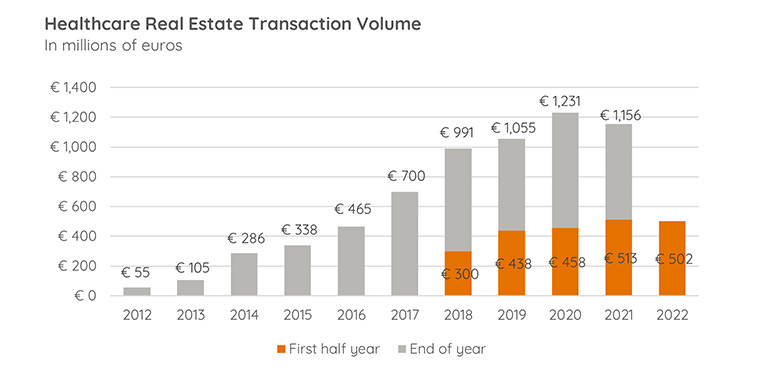

Healthcare real estate transaction volume exceeds half a billion in first half of 2022

7 juli 2022

So far, the healthcare real estate asset class seems unaffected by the challenges facing the real estate market. Research conducted by Capital Value shows that more than €500 million's worth of healthcare real estate was sold in the first six months of 2022, which is comparable to the record volume achieved in the first half of 2021. The lion's share of this volume (87%) consisted of sheltered housing; the remainder concerned first-line and second-line healthcare properties. Real estate funds (listed and mixed) and institutional investors were responsible for the largest part of the investment volume: 63%. Nearly half of the volume (43%) was invested in new build or conversion projects. At €7.5 billion, the demand for healthcare real estate among investors will remain very high for the next three years. Due in part to the ongoing shortages and sustainability targets, the healthcare real estate asset class has the potential to continue growing in coming years.

Real estate funds dominate

Over the past year, real estate funds played an important role in healthcare property purchases. Private and mixed real estate funds accounted for 23% of the transaction volume. Listed real estate funds were responsible for 18% of the total transaction volume. Cofinimmo's purchase of an intramural healthcare property scheduled to be newly built in Hoogerheide (€26 million) and the purchase of the residential care property Park Boswijk in Doorn by De Vrije Blick (€45 million) are good examples.

Institutional investors also accounted for an important share of the transaction volume, at 22%. Along with listed real estate funds, these were the largest purchasers of prospective new build healthcare real estate, and therefore play an important role in reducing the shortage of suitable sheltered housing. A good example of this is the purchase by Bouwinvest of a development comprising 300 intramural and extramural sheltered homes on Loevesteinlaan in The Hague.

Healthcare real estate remains a stable market for investors

The fact that the first half of 2022 matched the record volume over the first six months of 2021 underlines the stability of healthcare real estate relative to the other asset classes. The average volume per transaction showed a mild increase in 2022, rising from €8.4 million in 2021 to €8.5 million in 2022. The number of transactions in the first six months remained stable at 59. The number of transactions in the first half of 2021 was 60, and in the first half of 2020, 58. Amounting to €7.5 billion, the demand for healthcare real estate among investors will remain very high in the coming three years. The available capital relative to the size of the healthcare real estate market and the immense investment targets within the market (shortages and qualitative mismatch) mean that this asset class has significant potential to grow further in the coming years.

Manon Kuipers, Director of Healthcare Property & Housing Association Property at Capital Value, says: "The figures for the first half of 2022 show that healthcare real estate remains a stable asset class in the current market, with sufficient investment opportunities. In the past six months, additional new foreign parties entered the Dutch healthcare real estate investment market, such as the Belgian insurer AG Real Estate (purchase of a multifunctional residential care centre in Dronten, via Sectie5) and Patrizia, from Germany (purchase of residential care property De Keyzer in Amsterdam). Due to the challenges facing the new build segment and the announced transfer tax increase, we expect an increase in the demand for and supply of existing properties. This would mean that the upward trend in the transaction volume over recent years will continue."

Growing role of associations in sheltered housing

At 9% of the total transaction volume, housing associations provide an important contribution to the expansion and renovation of the healthcare real estate stock. Housing associations primarily purchased new-build healthcare real estate. For instance, Stichting Woonopmaat realised 35 sheltered homes for physically impaired young adults in Beverwijk, and Woonzorg Nederland acquired a development of 135 sheltered homes from Maaswonen in Rotterdam. Stichting Laurens will be responsible for the property management. It is expected that housing associations will assume an even more important role in investments in senior housing and healthcare real estate in the coming years, primarily due to the abolishment of the landlord levy, the ageing tenant pool and local performance agreements in the areas of housing and care.

Sustainability a target for investors and healthcare institutions

Compared to 2021, the proportion of new-build and conversions remained stable over the past six months, at 43%. The proportion of new build transactions is expected to continue increasing in the coming years, due in part to the high sustainability targets in the healthcare real estate market. "Investors place much value on the sustainability of healthcare real estate," says Manon Kuipers. "Institutional and listed funds are exclusively focusing on acquisitions with a B label or better. Other investors are less rigid in their label requirements when purchasing, but it is increasingly common for them to set conditions with regard to sustainability."

Healthcare institutions are also increasingly concerned about sustainability, so that investors and healthcare institutions increasingly find themselves on the same page in this respect. A good example of this trend is the transaction of a portfolio between the healthcare institution Siza (seller) and real estate fund Sectie5 (purchaser), with the healthcare institution leasing the property from the investor on a long-term basis. The parties have agreed that part of the properties must obtain energy label C by 2023, and energy label A by 2030. Financers, too, are increasingly critical with regard to the sustainability of real estate; as an example, the aforementioned transaction will be subject to an interest rate reduction if the properties obtain energy label C or better.

Healthcare institutions sold more real estate in the first half of 202 than in the same period of the preceding year. More than a third of the total number of sales in the past six months involved a healthcare institution as a seller. As a result, these institutions were responsible for 15% of the total sold volume, making them an important supplier of investment opportunities. This trend is expected to continue, with healthcare institutions and investors collaborating more closely over the coming years in order to realise the sustainability targets and address the shortages in this sector.