Strong first six months for residential investment market in 2022

18 juli 2022

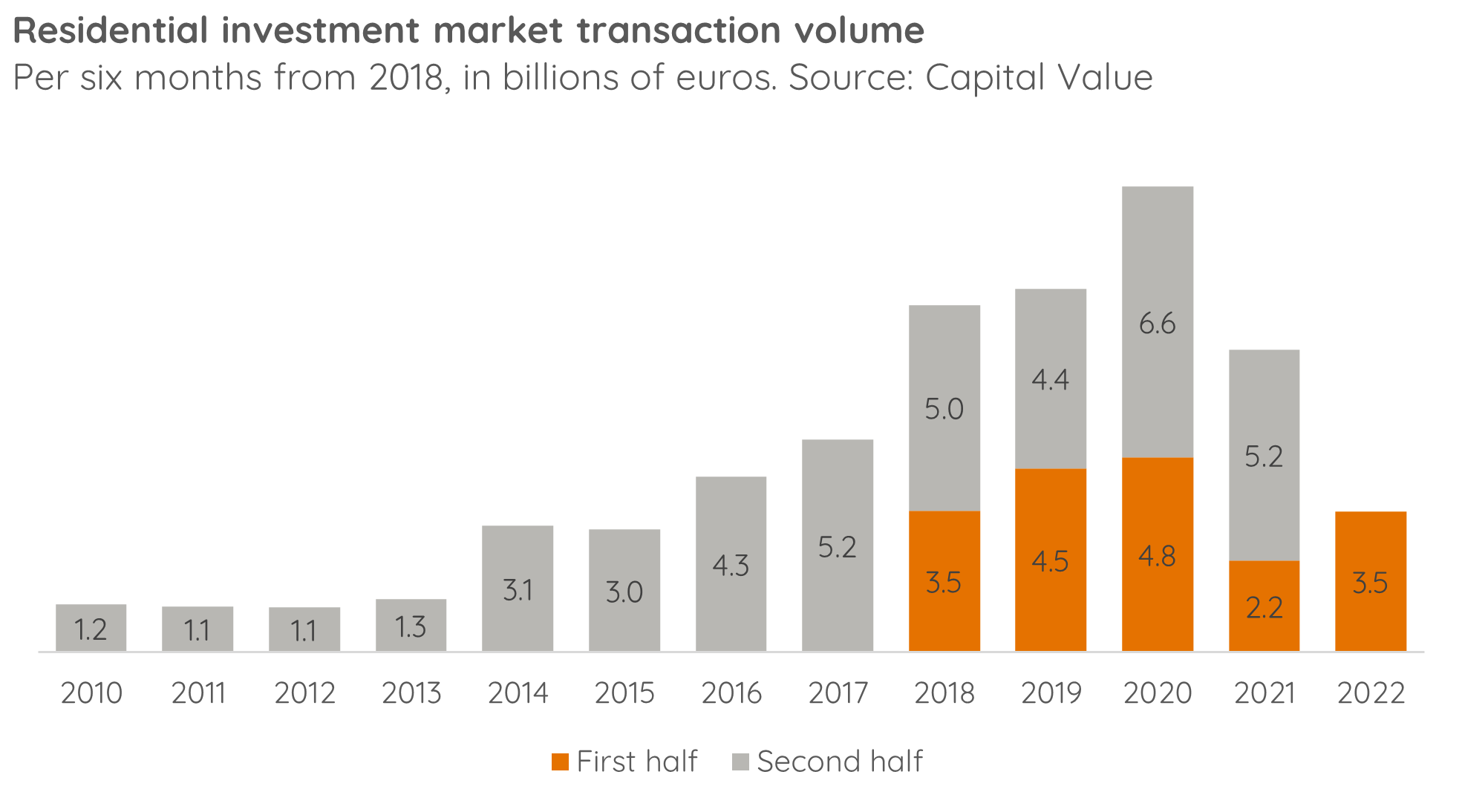

The transaction volume in the Dutch residential investment market saw a strong first six months this year. The volume of the transactions in existing and new rental homes increased to €3.45 billion in the first half of 2022, 53% higher than in the first half of 2021. Of particular note is the increased interest among housing associations, which purchased significantly more new and existing rental homes compared to the previous year. These strong first six months are a reflection of the confidence that investors have in the Dutch housing market, which remains robust despite the war in Ukraine, as well as the rising inflation and interest rates. However, many parties are concerned about the feasibility of new-build projects, due to the combined effects of increased construction costs, the raised interest rate and the plans to regulate the medium-priced rental sector. Expectations are that the number of new-build projects will fall in the second half of 2022 if the announced regulations turn out to have significant negative consequences for institutional investors.

Transaction volume in first six months increased to €3.45 billion

While the first half of 2021 was marked by a low transaction volume caused by a lack of supply, 2022 was off to a strong start. After six months, sales of new and existing rental homes now total €3.45 billion. This demonstrates investors' continued interest and confidence in the Dutch residential investment market. The transaction volume over the first half of 2022 is comparable to 2018. The strong first six months of 2022 were primarily driven by Dutch investors, who accounted for 75% of the transaction volume. In previous years, the share of Dutch investors stood at approximately two-thirds of the volume. This difference is the result of a cautious attitude among international pension funds, which are faced with rising capital market interest rates and uncertainty relating to the regulations that have been announced for the medium-priced rental sector. This "wait-and-see" attitude on the part of international pension funds is detrimental to the production of large-scale (> EUR 100 million) new-build properties in the medium-priced sector, as it is above all these pension funds which normally have the capacity to raise sufficient capital to fund such projects, which Dutch funds tend to consider too large.

All-time highest measured share of housing associations in transaction volume

Housing associations have been doing exceptionally well under the current circumstances. In the first half of 2022, they realised a share of 23% in the total transaction volume, with a total investment of €804 million. This is the largest share recorded to date. In 2020, associations accounted for 16% of the transaction volume; in other years, this share was 5% or lower. Investments in newly built rental homes formed 42% of the transaction volume of housing associations in 2022. Due to the abolishment of the landlord levy in 2023, housing associations have more capital available for investments in new and existing rental homes. The fact that they can obtain financing under more favourable conditions than market players also means that they are not affected as much by the rising capital market interest rate. These favourable circumstances are good news, because the expansion and sustainability targets that associations have agreed with Minister for Housing and Spatial Planning Hugo de Jonge are ambitious.

Regulation of free market rent may have major consequences for the feasibility of new-build projects

Market conditions in the first half of 2022 were marked by increased concerns among investors with regard to the regulations that have been announced for the medium-priced rental sector. Due to the increased construction costs and interest rate, many projects are under strain. The construction of up to 25,000 homes may be postponed in 2022, and the number of construction permits issued this year is also lower than in 2021. The lack of clarity regarding the forthcoming regulations is a cause of concern for many institutional investors.

According to Marijn Snijders, Managing Director at Capital Value: "There is a clear desire among pension funds and housing associations to continue investing in the medium-priced sector, but the lack of clarity with regard to the regulations makes it difficult to price and underwrite new-build projects. Many projects are being postponed. The big question is to what extent the rapidly rising construction costs and the increasing interest rate will be proportionate to a rent limitation in the medium-priced rental segment. We therefore call on the Ministry to provide more clarity about the regulations it has announced as soon as possible, so that we can keep the production of new medium-priced rental homes at the required level. Many municipalities already have regulations in place for new-build projects, and regulation at the national level will work at odds with these municipal rules. We have already called for a reduction in the VAT rate for the costruction costs of affordable rental housing in order to prevent the housing market's stagnation from escalating even further."