A sound optimism dominates the healthcare real estate market

9 juli 2020

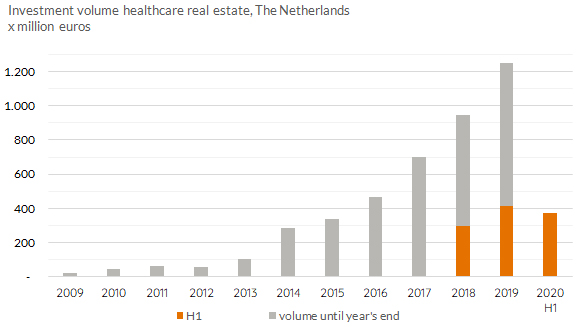

In the first half of 2020, approximately 375 million euros was invested in healthcare real estate. These investments pertained to both extramural and intramural healthcare homes and cure real estate. Four hundred fifteen (415) million euros was invested in healthcare real estate last year during the same period which is approximately 10% more than this year. Nevertheless the market is showing both confidence and optimism. Investors have more capital available for healthcare real estate than ever before. In addition, healthcare institutions increasingly consider investors to be strategically cooperative partners, a role which was previously filled by housing associations. Around 50% of healthcare real estate sold originated from healthcare institutions. Another positive development is the share of new-build developments in the transaction volume which totalled more than 50%. This provides a significant contribution to reducing the shortages and at the same time improves quality with regard to outdated healthcare real estate.

Fund initiators invest more in healthcare real estate

The transaction volume in healthcare real estate has been characterised by an increasing number of Dutch fund initiators in recent years. The percentage of this type of buyer grew from approximately 16% in 2018 to around 30% in 2020. An explanation for the success of this type of buyer is the flexibility and speed with which these investors act in the healthcare real estate market. Fund initiators focus in particular on the existing stock of healthcare real estate. This makes their strategy complementary to that of institutional investors who primarily focus on the acquisition of new-build output. Buyers are predominately Dutch (84%) followed by Belgian investors (12%) in the total transaction volume.

Decreasing yields in the care segment

The number of investors in the healthcare real estate market is rising, just as the mandates of established investors. However, the supply of qualitatively suitable healthcare real estate is still lagging behind demand. Manon Kuipers, Specialist Healthcare Real Estate Capital Value, "We see an increasing number of strategic decisions in the bidding processes as a result of capital pressure on investors. High bids are being made for currant propositions in order to increase the chances of a purchase. We see major differences with the other bidders in the process. Initial yields are under pressure. Whereas this primarily involved extramural healthcare real estate previously, it is now also happening in qualitatively good intramural care properties."

400,000 new homes needed for the elderly

There is a great demand from users for care properties. According to ANBO, there is currently a shortage of around 100,000 homes for senior citizens, and that shortage increases annually by approximately 20,000. Kees van Harten, Director Capital Value, "Over the next twenty years, no fewer than 400,000 homes must be added that are suitable for senior citizens via home adaptations and new-build development. Despite the available capital for investments in this asset category, project developers, investors, healthcare institutions and housing associations are not able to collectively add sufficient supply to the stock." To address the shortage, cooperation and new alliances are required, even between parties that previously operated in different worlds. Performance agreements at the municipal level make it possible to identify local challenges and opportunities. In addition to the fact that there is a need for suitable accommodation for seniors and those who need care, this will also stimulate flow and create opportunities for other groups in the housing market.

Pressing need for housing associations to invest in homes for seniors

Housing associations are geared to a significant part of the target group with affordable rental homes, namely seniors who require (future) light care. This applies to the group that can live at home for as long as possible based on the 'Scheiden Wonen & Zorg' policy. More than half of housing association tenants are expected to be 65 and older by 2030. The existing stock does not currently meet demand. At the same time, (residential) care properties in particular, such as multifunctional residential care centres, are not part of the portfolio strategy. Through the sale of such properties with a higher risk profile to investors, resources become available for converting the existing stock of rental homes to life cycle housing. Moreover the priority remains high for adding new social senior housing to the stock.

An abundant amount of confidence in healthcare real estate investment

The asset category healthcare real estate has developed at a rapid pace. Earlier this year, research from Capital Value showed that investors have approximately 3.4 billion euros available for investment in healthcare real estate. In addition to these numbers, during the first half of 2020, various new foreign investors announced their intention to concentrate on the Dutch healthcare real estate market. The significant demand for Dutch healthcare real estate from investors confirms their confidence in this asset category, even during the corona crisis. The increasing demand from users and stable rental returns make this product more resilient to economic fluctuations in comparison to other asset categories.