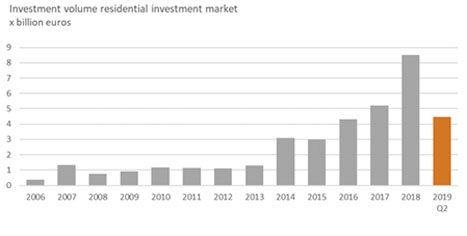

Residential investments in 2019 already at an all-time high

3 juni 2019

No less than an amount of 4.5 billion euros was invested in Dutch rental dwellings in the first five months of this year, compared to 3.5 billion euros during the same period last year. 2019 is bound to become a record breaking year as this trend is expected to continue until the end of the year. Capital Value predicts that the transaction volume in the residential investment market may rise to 10 billion euros, which is a growth of approximately 20%. Never before have so many rental dwellings been sold in The Netherlands.

Over 24,000 dwellings were sold in the first five months

In the first five months of this year a number of large-scale transactions were realised and the number of existing dwellings sold was almost as high as during the whole of 2018. The number of newly built houses sold is slightly less than half of the total number in 2018, which is remarkable as rental dwellings are highly sought after by pension funds.

Highest share of international investments so far

International investors such as Heimstaden, Blackstone and CAPREIT have realised a number of large acquisitions, which brings the share of international investments during the first six months of 2019 to 48.5 % of the total volume, which is a record in itself. Comparing this to previous years shows a share of 35% in 2018 and 27% in 2015. During 2018 international investors invested approximately 3 billion euros, over the past five months they invested already 2.2 billion euros. It is expected that this year the total volume of international investments will rise high above last year's.

Mainly institutional investors are active in the market

In particular institutional investors, both Dutch and international, have bought residential real estate. Over the next few weeks a number of large investments in new mid-segment rental residential development projects by institutional investors will be announced. Strikingly, housing associations have invested no more that 130 million euros while research has indicated that their degree of liquidity is much higher than in the past.

Over 20 billion euros available

Research by Capital Value has indicated that both Dutch and international investors have considerable capital at their disposal for 2019 and 2020. More particularly, they have the potential to invest over 20 billion euros in Dutch rental dwellings.

Lowest number of building permits since the last ten quarters

Despite the fact that the Dutch government had the ambition to issue more building permits and increase the building of new residential real estate, exceptionally few permits were issued in Q1 2019. Only 14,537 were issued, which is the lowest number since Q3 2016. The expected number of 75,000 new residential dwellings will not be feasible if this trend continues, as 95,000-115,000 new dwellings are needed annually to reduce the shortage. In large cities the low number of permits issued is induced by slow and delaying procedures. Other causes are lack of capacity and a mismatch between municipalities' ambitions to reduce shortages in the local housing market on the one side and regulations and policies on prices of land on the other hand.

Marijn Snijders, Managing Director of Capital Value states: "The low number of building permits issued seriously puts at risk the reduction of the still increasing housing shortage, especially with the large availability of capital to build affordable (social) and mid-segment rental dwellings. More and more complex regulations, growing prices of land and building costs may prevent the realisation of the required number of newly built homes. Creating more residential dwellings is the only way to stop the increase of residential rental- and sales price levels."